FINDING A COPILOT FOR FINANCIAL ADVICE

For the last 30 years, RAA has been focused on serving the financial needs of airline pilots and their families. A part of this commitment requires us to continually understand how pilots are utilizing financial advice, how satisfied pilots are with the support they receive, and what value pilots are gaining from the relationship with an advisor.

While we’ve come a long way in this pursuit, we also recognize that this process is never fully complete. With this in mind, we recently conducted a nationwide survey which reached 174 pilots from several carriers. All pilots surveyed were between ages 64 and 67, and none were RAA clients to ensure the results were unbiased and accurately reflect our industry.

Here are several of the key findings we uncovered in our research.

WHEN AND WHY PILOTS ARE WORKING WITH ADVISORS

In most of our professional and personal lives, timing is critical. This holds true whether you are playing golf, starting a family, or lining up for a crosswind landing. Timing is also critical as it relates to hiring a professional financial advisor. So, when do pilots begin this process?

Our research showed that the average pilot who chooses to work with an advisor begins thinking about partnering with an advisor at age 52 and – if they decide to work with a professional – a formal engagement begins, on average, at age 58. On the one hand, this is a good thing, as it shows that pilots are taking time to find, get to know, and select a financial advisor to manage their assets. Considering the magnitude of this decision and how many advisors there are to choose from, it’s great to see that pilots are taking the time to explore their options and find the right fit for themselves, their family, and their legacy.

THE VALUE IN STARTING EARLIER

This data also reveals that pilots could be starting this process much earlier in life. Since we know that the average pilot is beginning an advisory relationship at age 58, this means that the average pilot is working with an advisor for just seven years before they are required to hang it up at age 65. For pilots who elect to retire early, the financial planning process may begin even closer to their retirement date.

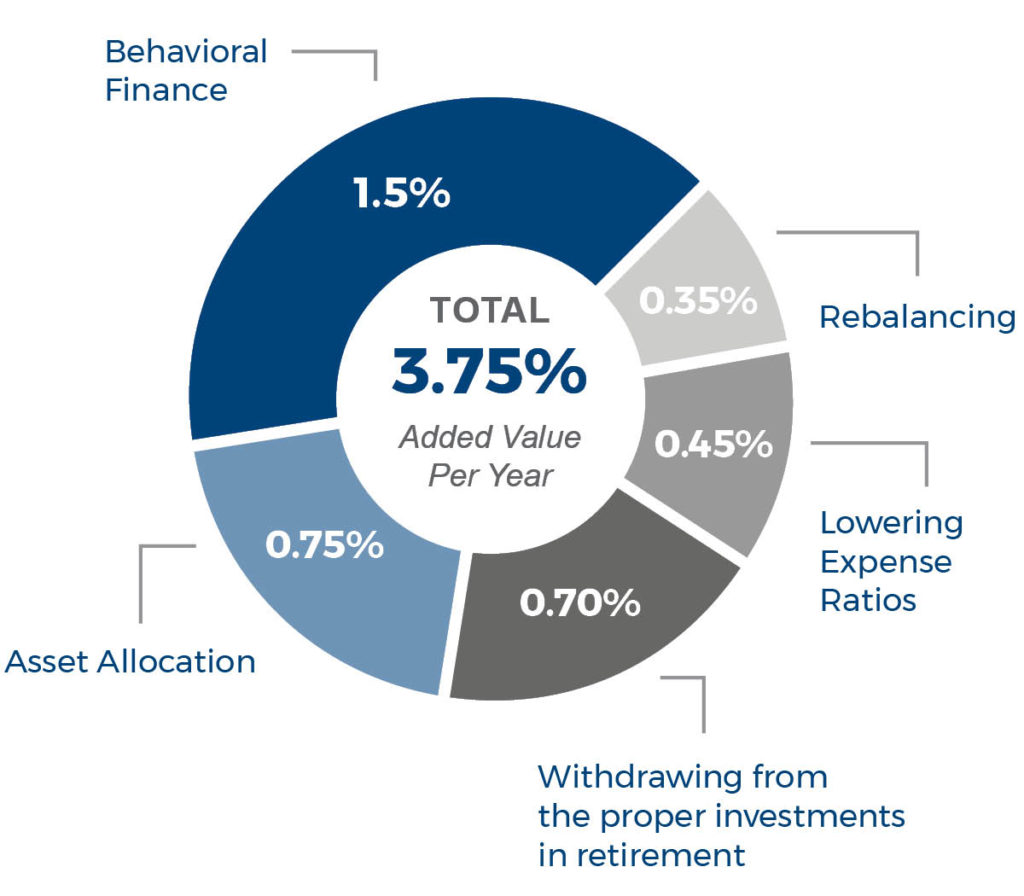

By beginning the search for a financial advisor before the age of 45, when significantly fewer pilots have this mindset, the difference in lifetime returns through the management of investor behavior, lowered expense ratios, rebalanced portfolios, and enhanced asset allocation strategies can add up significantly. In fact, according to a report by Vanguard, these types of advisory services can provide clients with an additional 3.75% in annual returns1. These are additional returns which could begin working for pilots earlier in life when they partner with an advisor, helping to secure retirement when the time comes.

The bottom line? Pilots are taking a good amount of time to choose the right advisor – but we’d encourage you to begin thinking about the process earlier in your career.

Download the Report

This is just one of the many insights that you’ll find in our full report. We invite you to download the full report to learn how your colleagues are using paid financial advice and other key findings which can help secure your financial future.

[maxbutton id=”14″ ]

ARE YOU READY TO GET STARTED?

Request a call today to speak with an advisor and learn how RAA can help you achieve financial security now and in the future.

[maxbutton id=”3″ ]

1Information obtained from the Vanguard report titled Putting a Value on Your Value: Quantifying Vanguard Advisor’s Alpha. Vanguard is an independent third party and not associated with RAA.